Bitcoin has been on a remarkable run in recent weeks, surging to record highs and sparking renewed interest in the world’s most famous cryptocurrency. Many experts and analysts have been scratching their heads trying to figure out what’s behind this sudden price surge. In this post, we’ll explore some of the possible reasons why bitcoin has been increasing in price, particularly as it pertains to the current banking crisis, the failures of stable coins, and exchange firms like FTX.

One possible explanation for bitcoin’s recent price surge is the ongoing banking crisis. Banks and financial institutions around the world have been struggling with a range of issues, from low interest rates to sluggish economic growth. This has led many investors to look for alternative investments that can offer a higher rate of return. Bitcoin, with its decentralized and deflationary nature, has become increasingly attractive to investors looking for a safe haven from the turmoil in the traditional financial markets.

Another factor driving bitcoin’s price increase is the failure of stable coins, which are digital tokens designed to maintain a stable value by pegging their price to a traditional currency like the US dollar. Stable coins have been touted as a solution to the volatility of cryptocurrencies like bitcoin, but they have been beset by a range of problems, from insufficient collateral to a lack of transparency. This has led some investors to turn to bitcoin as a more stable alternative, particularly as the cryptocurrency has become more widely accepted by retailers and businesses.

The recent failures of exchange firms like FTX have also played a role in bitcoin’s price surge. FTX, which is one of the largest cryptocurrency exchanges in the world, recently suffered a massive liquidation event that left many traders with significant losses. This event highlighted the risks associated with centralized exchanges and raised concerns about the security and stability of the cryptocurrency market. Bitcoin, with its decentralized and trustless nature, is seen as a safer alternative to centralized exchanges and has attracted more investors as a result.

In addition to these specific factors, there are also broader trends at play that are driving bitcoin’s price increase. The COVID-19 pandemic has accelerated the shift to digital payments and online commerce, which has made cryptocurrencies more attractive to businesses and consumers alike. The growing acceptance of cryptocurrencies by major companies like Tesla and PayPal has also helped to legitimize bitcoin and other cryptocurrencies in the eyes of the general public.

Despite the various factors driving bitcoin’s price increase, there are also risks and uncertainties associated with investing in the cryptocurrency. Bitcoin’s price is notoriously volatile, and investors should be prepared for significant fluctuations in value. There are also regulatory risks, as governments around the world grapple with how to regulate cryptocurrencies and prevent their use in illicit activities.

In conclusion, the recent increase in bitcoin’s price can be attributed to a range of factors, including the ongoing banking crisis, the failure of stable coins, and the risks associated with centralized exchanges like FTX. However, broader trends such as the shift to digital payments and the growing acceptance of cryptocurrencies by major companies have also played a role. While investing in bitcoin can be risky, it is clear that cryptocurrencies are here to stay and will continue to play an important role in the global economy for years to come.

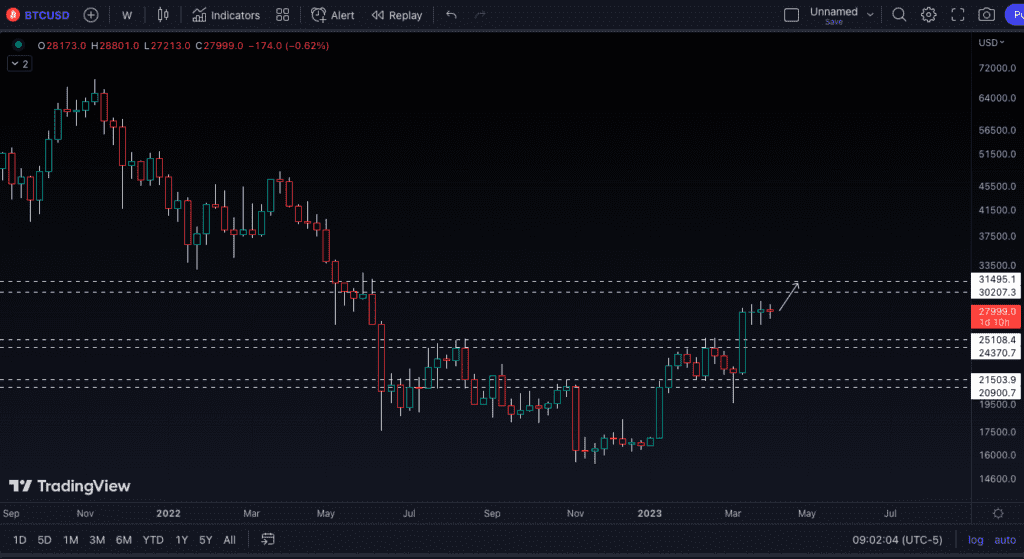

Bitcoin is currently Trading around $28,000 and we are looking for a move up to about $30-$31,000 next.